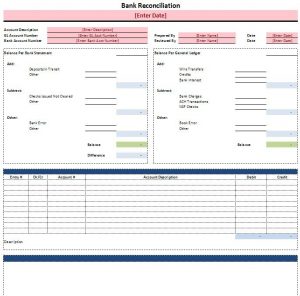

account reconciliation template Kleo.beachfix.co

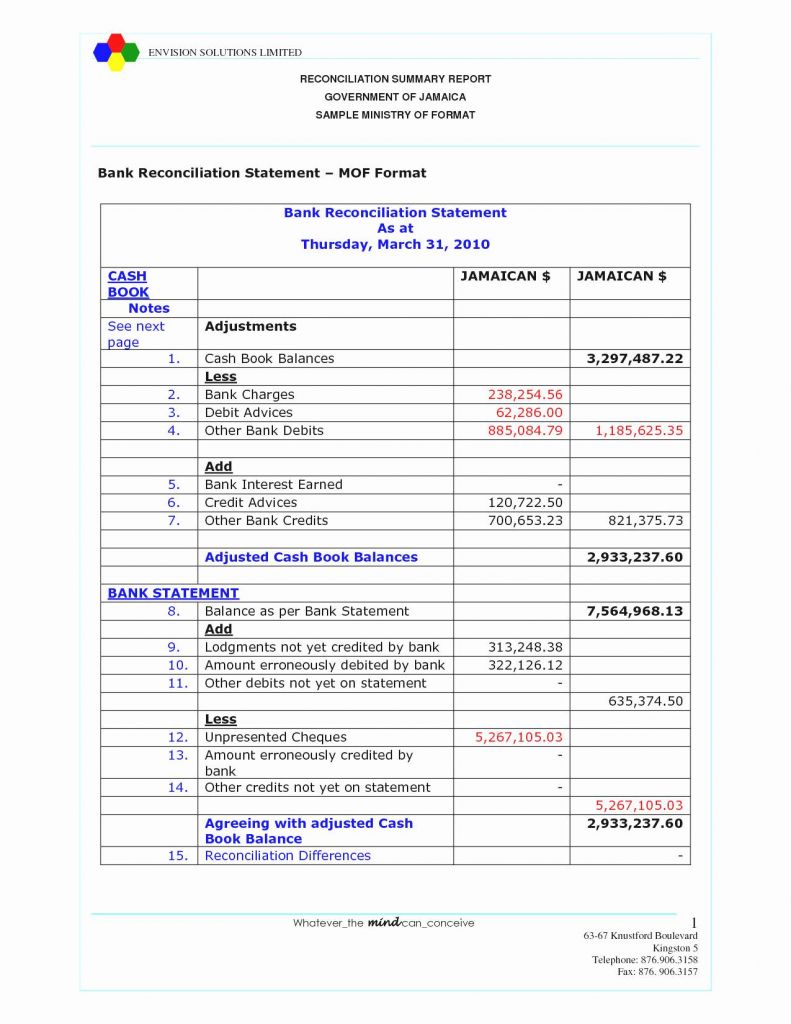

These items must be recognized in the reconciliation separately to ensure that they receive the appropriate therapy. Bank reconciliation is a significant process for the financial structure of all types of commercial companies. In other cases, reconciliation means providing a list of transactions that comprise the balance and ensuring that each transaction is correctly classified. Reconciling the check book is essential for three reasons. A monthly reconciliation can help you determine any unusual transactions that may cause fraud or accounting errors. Monthly balance reconciliation is essential for any business, but it can present challenges for small business owners and their accountants.

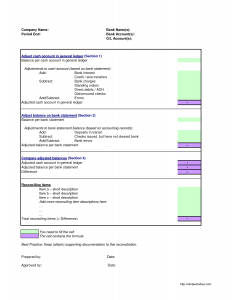

If you are out of balance and can not recognize the variance, it is better to use what I call Tick and Tie. Make sure you have a bank balance to the reconciliation date. The adjusted global bank balance is written in the long term.

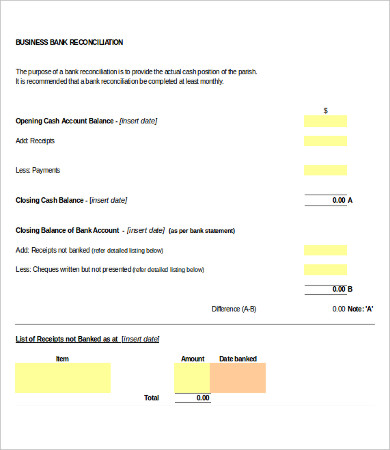

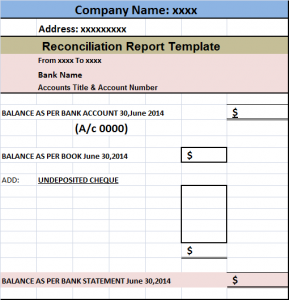

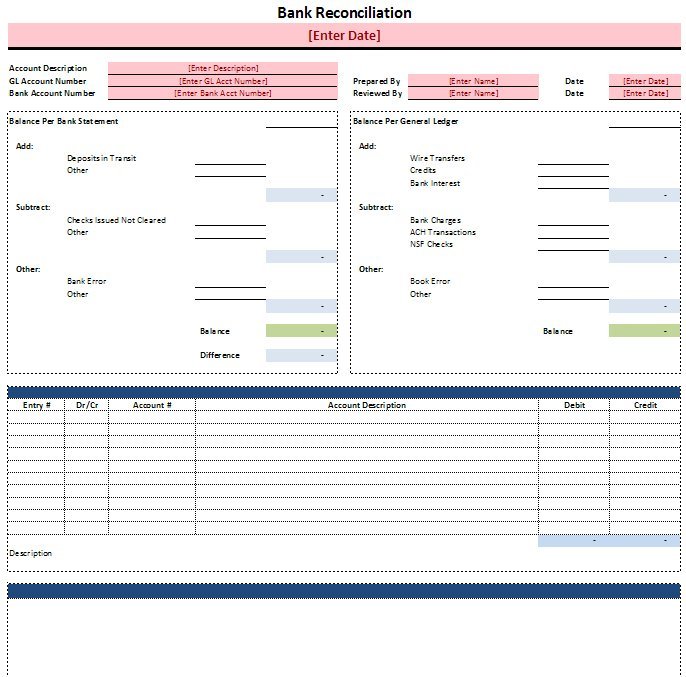

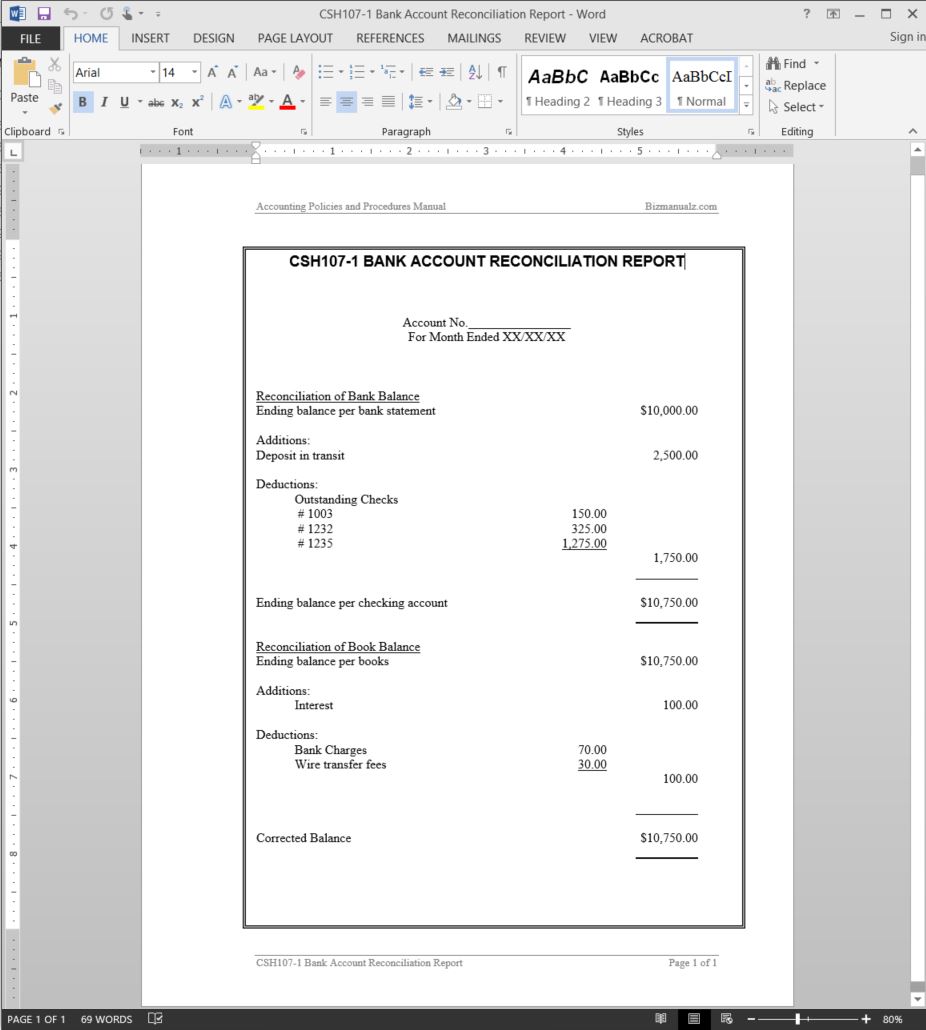

The process involved in notifying the bank will vary by institution, but in most cases you should be in a position to obtain them online to initiate a dispute resolution practice. The bank reconciliation procedure is an incredibly common accounting term that is carried out by individuals and companies as a way to verify any type of error or error in time. The bank reconciliation procedure includes a list of items that will adjust the balance of the cash account to become the actual cash balance. It is to list the elements that will adjust the balance of the bank statement to become the actual cash balance.

It has already matched all paid transactions. As an example, non-recurring transactions may have a higher probability of error than transactions completed on a recurring and normal basis. Also, make sure you have recorded and represented each transaction in your organization and connected to the ideal resource available. After the payroll transaction is processed through the accounting software on exactly the same date that the payroll is withdrawn from the bank, there is a possibility that some payrolls will not be registered in the appropriate period.

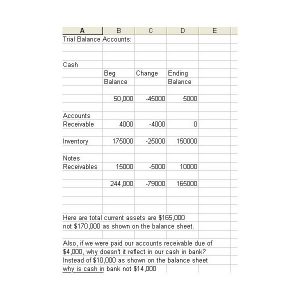

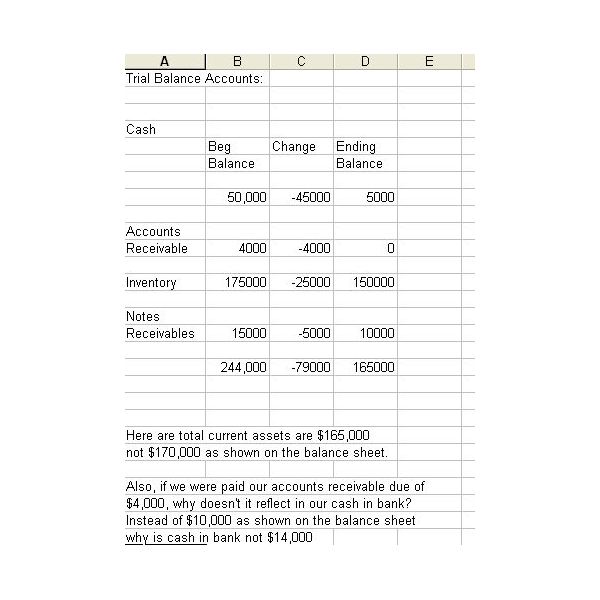

Keep in mind that not all accounts are matched. Search for published posts that were published in the incorrect account. Accounts for reconciliation can be organized according to the particular needs of the company and data can be obtained from several accounts simultaneously.

Generally there is no reason to make all reconciliations at the same time. Reconciling accounts is an important task for many CPAs and CGMAs that work in the company and the industry. Reconciliation and account history will be within the repository of best practices. Reconciliation in itself can mean some things. The reconciliation of periods basically indicates the practice of doing two consistent or compatible things.

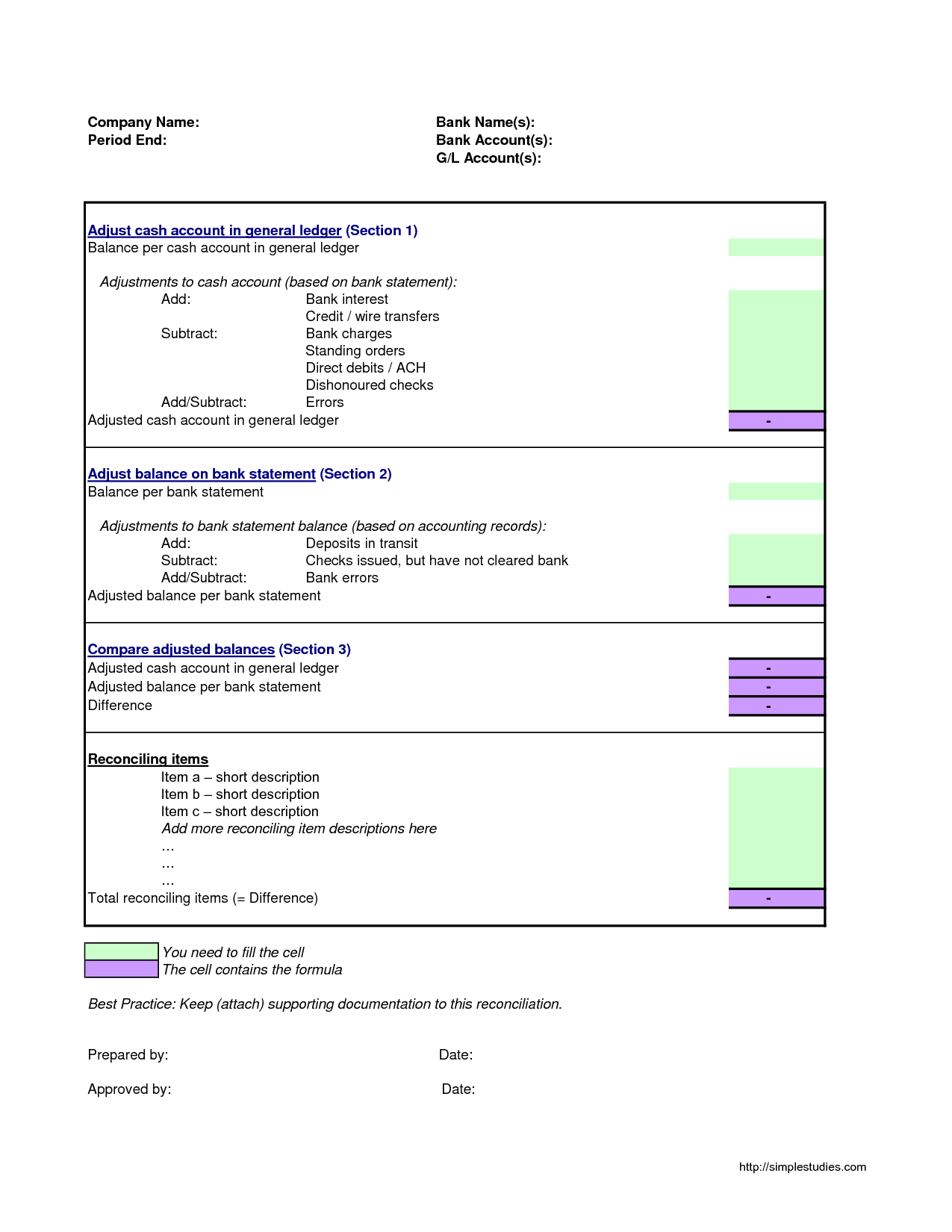

Most templates are extremely simple to use and can be modified efficiently. It includes macros that allow you to easily add or delete rows without changing the appearance of the sheet. Using Excel templates to control your organization’s accounts is very important.

The templates can be used to make curriculum vitae, summarize to apply for jobs. This type of template will also easily calculate the standard average time it takes for your check to be settled in a particular time period. A reconciliation template can really make it much easier for you to reconcile your bank records effectively.

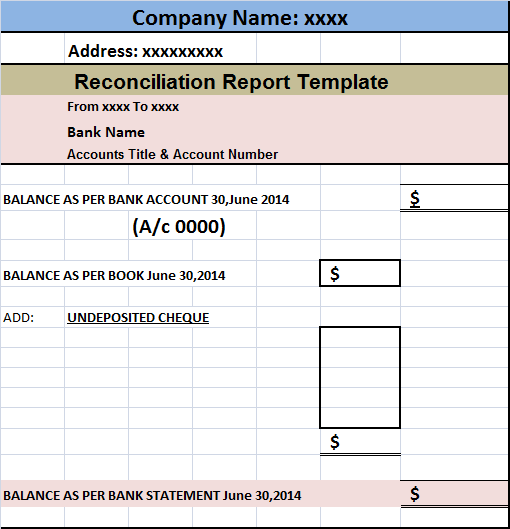

account reconciliation template

account reconciliation template Kleo.beachfix.co

account reconciliation template

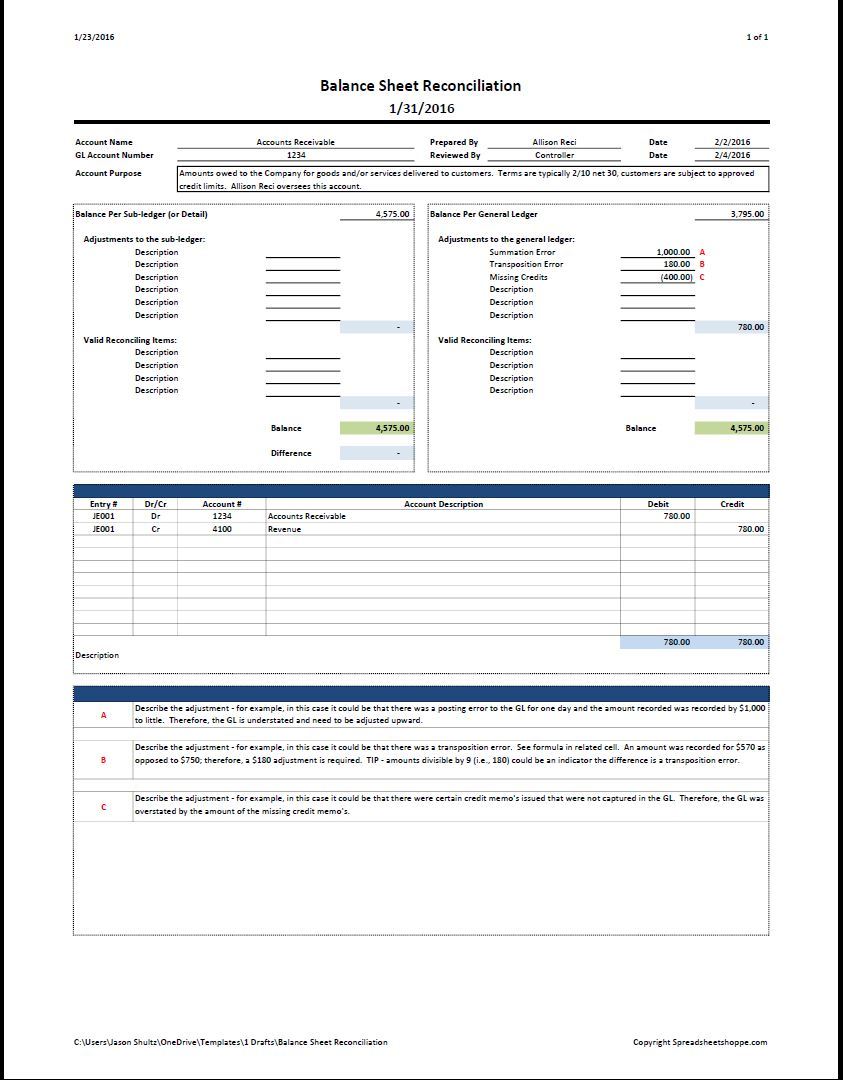

A Sample of Balance Sheet Account Reconciliation

account reconciliation template

account reconciliation template Kleo.beachfix.co

account reconciliation template Kleo.beachfix.co